What Items Are Sales Tax Exempt In Texas . learn how to collect and remit sales tax in texas, including the state and local rates, exemptions, and recent changes. sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. Local sales tax can be as much as an additional 2%. Find local tax rates, due dates, discounts, penalties, interest. Learn more about specific texas sales tax exemptions. common texas sales tax exemptions include those for necessities of life, including most food and health. learn how to register, report and pay sales and use tax in texas. the state of texas levies a 6.25% state sales tax. learn how to apply for sales tax, franchise tax and hotel occupancy tax exemptions based on federal or state exemption.

from mungfali.com

the state of texas levies a 6.25% state sales tax. Learn more about specific texas sales tax exemptions. Local sales tax can be as much as an additional 2%. learn how to register, report and pay sales and use tax in texas. common texas sales tax exemptions include those for necessities of life, including most food and health. learn how to collect and remit sales tax in texas, including the state and local rates, exemptions, and recent changes. learn how to apply for sales tax, franchise tax and hotel occupancy tax exemptions based on federal or state exemption. sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. Find local tax rates, due dates, discounts, penalties, interest.

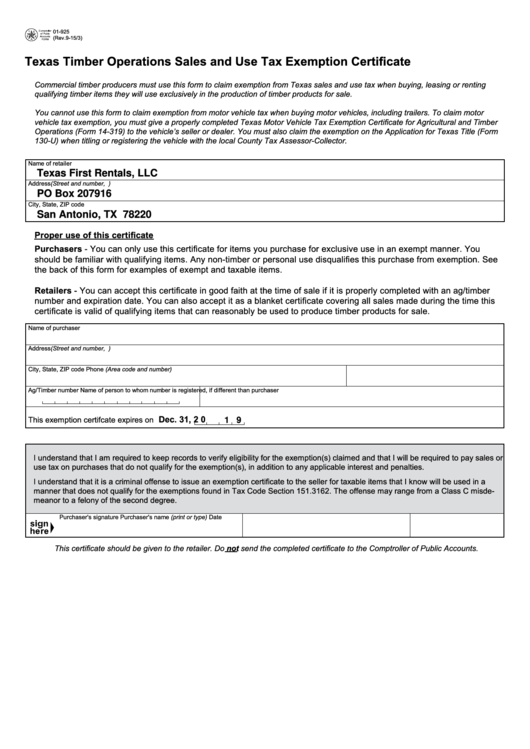

Texas Sales And Use Tax Exemption Blank Form

What Items Are Sales Tax Exempt In Texas Learn more about specific texas sales tax exemptions. Local sales tax can be as much as an additional 2%. common texas sales tax exemptions include those for necessities of life, including most food and health. learn how to register, report and pay sales and use tax in texas. learn how to apply for sales tax, franchise tax and hotel occupancy tax exemptions based on federal or state exemption. Learn more about specific texas sales tax exemptions. learn how to collect and remit sales tax in texas, including the state and local rates, exemptions, and recent changes. sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. the state of texas levies a 6.25% state sales tax. Find local tax rates, due dates, discounts, penalties, interest.

From digital.library.unt.edu

[Texas sales tax exemption certificate from the Texas Human Rights What Items Are Sales Tax Exempt In Texas Find local tax rates, due dates, discounts, penalties, interest. common texas sales tax exemptions include those for necessities of life, including most food and health. sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. Local sales tax can be as much as an additional 2%. . What Items Are Sales Tax Exempt In Texas.

From speedeeoilchange.blogspot.com

Texas Sales And Use Tax Resale Certificate Example / TaxExempt Forms What Items Are Sales Tax Exempt In Texas Find local tax rates, due dates, discounts, penalties, interest. the state of texas levies a 6.25% state sales tax. common texas sales tax exemptions include those for necessities of life, including most food and health. sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. . What Items Are Sales Tax Exempt In Texas.

From mungfali.com

Texas Sales And Use Tax Exemption Blank Form What Items Are Sales Tax Exempt In Texas learn how to register, report and pay sales and use tax in texas. Learn more about specific texas sales tax exemptions. the state of texas levies a 6.25% state sales tax. sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. Find local tax rates, due. What Items Are Sales Tax Exempt In Texas.

From www.exemptform.com

Form 01 339 Download Fillable PDF Or Fill Online Texas Sales And Use What Items Are Sales Tax Exempt In Texas Local sales tax can be as much as an additional 2%. sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. the state of texas levies a 6.25% state sales tax. common texas sales tax exemptions include those for necessities of life, including most food and. What Items Are Sales Tax Exempt In Texas.

From mungfali.com

Texas Sales And Use Tax Exemption Blank Form What Items Are Sales Tax Exempt In Texas Find local tax rates, due dates, discounts, penalties, interest. learn how to register, report and pay sales and use tax in texas. learn how to collect and remit sales tax in texas, including the state and local rates, exemptions, and recent changes. Local sales tax can be as much as an additional 2%. common texas sales tax. What Items Are Sales Tax Exempt In Texas.

From webinarcare.com

How to Get Texas Sales Tax Permit A Comprehensive Guide What Items Are Sales Tax Exempt In Texas Learn more about specific texas sales tax exemptions. learn how to apply for sales tax, franchise tax and hotel occupancy tax exemptions based on federal or state exemption. Local sales tax can be as much as an additional 2%. learn how to collect and remit sales tax in texas, including the state and local rates, exemptions, and recent. What Items Are Sales Tax Exempt In Texas.

From www.formsbank.com

Sales Tax Exemption List Form printable pdf download What Items Are Sales Tax Exempt In Texas Local sales tax can be as much as an additional 2%. common texas sales tax exemptions include those for necessities of life, including most food and health. learn how to register, report and pay sales and use tax in texas. learn how to collect and remit sales tax in texas, including the state and local rates, exemptions,. What Items Are Sales Tax Exempt In Texas.

From exolwrmuq.blob.core.windows.net

Texas Sales And Use Tax Form 01339 at Henry Cook blog What Items Are Sales Tax Exempt In Texas common texas sales tax exemptions include those for necessities of life, including most food and health. Find local tax rates, due dates, discounts, penalties, interest. Local sales tax can be as much as an additional 2%. learn how to apply for sales tax, franchise tax and hotel occupancy tax exemptions based on federal or state exemption. learn. What Items Are Sales Tax Exempt In Texas.

From learningdarkvonhack2n.z21.web.core.windows.net

Sales Tax Exemption Form Sample What Items Are Sales Tax Exempt In Texas learn how to apply for sales tax, franchise tax and hotel occupancy tax exemptions based on federal or state exemption. Find local tax rates, due dates, discounts, penalties, interest. the state of texas levies a 6.25% state sales tax. learn how to collect and remit sales tax in texas, including the state and local rates, exemptions, and. What Items Are Sales Tax Exempt In Texas.

From tutore.org

Sales Exemption Certificate Master of Documents What Items Are Sales Tax Exempt In Texas learn how to register, report and pay sales and use tax in texas. Find local tax rates, due dates, discounts, penalties, interest. sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. Local sales tax can be as much as an additional 2%. learn how to. What Items Are Sales Tax Exempt In Texas.

From www.pinterest.ca

Texas Sales And Use Tax Exemption Certification Blank Form With Regard What Items Are Sales Tax Exempt In Texas sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. common texas sales tax exemptions include those for necessities of life, including most food and health. learn how to apply for sales tax, franchise tax and hotel occupancy tax exemptions based on federal or state exemption.. What Items Are Sales Tax Exempt In Texas.

From tramiteseeuu.com

Texas “Sales & Use Tax Permit” y el “Resale Certificate” Todo lo que What Items Are Sales Tax Exempt In Texas the state of texas levies a 6.25% state sales tax. Local sales tax can be as much as an additional 2%. learn how to apply for sales tax, franchise tax and hotel occupancy tax exemptions based on federal or state exemption. Find local tax rates, due dates, discounts, penalties, interest. learn how to collect and remit sales. What Items Are Sales Tax Exempt In Texas.

From blanker.org

Texas Sales and Use Tax Exemption Certification Forms Docs 2023 What Items Are Sales Tax Exempt In Texas learn how to collect and remit sales tax in texas, including the state and local rates, exemptions, and recent changes. the state of texas levies a 6.25% state sales tax. Learn more about specific texas sales tax exemptions. Local sales tax can be as much as an additional 2%. sales tax is a crucial source of revenue. What Items Are Sales Tax Exempt In Texas.

From www.exemptform.com

Tx Form Sales Tax Exemption Fill Online Printable Fillable Blank What Items Are Sales Tax Exempt In Texas Find local tax rates, due dates, discounts, penalties, interest. learn how to apply for sales tax, franchise tax and hotel occupancy tax exemptions based on federal or state exemption. learn how to collect and remit sales tax in texas, including the state and local rates, exemptions, and recent changes. Local sales tax can be as much as an. What Items Are Sales Tax Exempt In Texas.

From printablemapaz.com

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas What Items Are Sales Tax Exempt In Texas sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. common texas sales tax exemptions include those for necessities of life, including most food and health. Find local tax rates, due dates, discounts, penalties, interest. learn how to collect and remit sales tax in texas, including. What Items Are Sales Tax Exempt In Texas.

From formspal.com

Texas Sales Tax Exemption Certificate PDF Form FormsPal What Items Are Sales Tax Exempt In Texas the state of texas levies a 6.25% state sales tax. learn how to collect and remit sales tax in texas, including the state and local rates, exemptions, and recent changes. Learn more about specific texas sales tax exemptions. sales tax is a crucial source of revenue for the state government in texas, and it is imposed on. What Items Are Sales Tax Exempt In Texas.

From mungfali.com

Texas Sales And Use Tax Exemption Blank Form What Items Are Sales Tax Exempt In Texas sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. learn how to register, report and pay sales and use tax in texas. learn how to apply for sales tax, franchise tax and hotel occupancy tax exemptions based on federal or state exemption. learn how. What Items Are Sales Tax Exempt In Texas.

From www.formsbank.com

Fillable Form 01925 Texas Timber Operations Sales And Use Tax What Items Are Sales Tax Exempt In Texas common texas sales tax exemptions include those for necessities of life, including most food and health. learn how to register, report and pay sales and use tax in texas. sales tax is a crucial source of revenue for the state government in texas, and it is imposed on most retail. the state of texas levies a. What Items Are Sales Tax Exempt In Texas.